In today's fluctuating economic landscape, intelligent investors must plan carefully to mitigate risk and optimize returns. While uncertainty can be daunting, it also presents opportunities for those who possess a sharp eye and a disciplined approach.

- Regularly review your investment holdings to confirm it aligns with your current economic targets.

- Spread your investments across multiple asset categories to safeguard against potential losses in any single sector.

- Consider alternative investment methods that might offer enhanced profitability in a unpredictable market.

Seek advice from a experienced financial consultant to develop a personalized investment plan that meets your specific needs and factors.

Financial Turbulence: Guiding Smart Investments

Navigating the unpredictability of economic volatility presents a unique challenge for financially savvy individuals. In an environment marked by shifting market conditions and volatility, formulating a effective investment plan becomes paramount.

Strategic investors recognize that volatility is an inherent feature of financial markets. They adapt their portfolios to absorb risk while pursuing potential returns.

A key aspect of successful investing in volatile times is {diversification|. This involves spreading investments across a range of asset classes to minimize the impact of any single investment's performance on the overall portfolio.

Due diligence remains crucial for identifying investments that demonstrate a strong financial foundation.

Moreover, investors should maintain a disciplined investment horizon. Navigating short-term market volatility and emphasizing on the fundamental value of investments can generate consistent returns over time.

Navigating the Investment Landscape: Strategies for Success

Embarking on an investment journey requires a strategic approach that harmonizes risk management with return maximization.

- A comprehensive understanding of your investment goals, coupled with a meticulous evaluation of market trends, is paramount to generating long-term prosperity.

- By diversifying your portfolio across various asset classes and leveraging disciplined investment strategies, you can mitigate potential losses while improving the likelihood of achieving your desired outcomes.

- Staying abreast of market fluctuations and modifying your portfolio accordingly is crucial for navigating the dynamic world of investments.

Smart Strategies for Formulating a Resilient Investment Portfolio

A resilient investment portfolio is one that can withstand market volatility and continue to generate check here returns over the long term. To achieve this, investors should consider adopting a variety of smart strategies. Firstly, it's crucial to distribute your investments across different asset classes, such as stocks, bonds, and real estate. This helps to minimize risk by ensuring that if one asset class underperforms, others can counterbalance the losses.

Additionally, it's important to conduct thorough research before allocating in any particular asset. This includes evaluating the company's financial statements, understanding its industry dynamics, and considering the overall economic projection.

Periodically reviewing your portfolio and making adjustments as needed is also essential. Market conditions can change rapidly, so it's important to stay up-to-date with current trends and rebalance your investments accordingly.

Finally, consider working with a qualified financial advisor who can provide personalized guidance and support in developing a tailored investment strategy that meets your individual needs and goals.

Decoding Market Fluctuations: How to Make Data-Driven Investment Choices

Navigating the complexities of the financial market can feel like traversing a labyrinth. Market fluctuations, typically unpredictable and rapidly evolving, present significant challenges for investors seeking to maximize returns. However, by embracing a data-driven approach, investors can empower their decision-making process and navigate these volatility with greater confidence.

- The foundation of a successful data-driven investment strategy lies in collecting comprehensive market data.

- Harnessing advanced analytics and numerical models allows investors to identify patterns and trends that may not be readily obvious.

- By adopting a defined risk management framework, investors can mitigate potential losses and preserve their capital.

Ultimately, data-driven investment choices enable investors to generate more informed decisions, boosting the likelihood of achieving their financial goals in this dynamic and ever-changing market landscape.

Navigating of Intelligent Investing: A Framework for Success Amidst Uncertainty

In today's volatile market, constructing a sound investment plan is paramount. Intelligent investing transcends basic speculation; it demands a calculated mindset coupled with meticulous analysis. By adopting a framework grounded in fundamental principles, investors can minimize risk and strive for long-term growth.

A robust investment strategy must encompass portfolio allocation to protect against unforeseen market swings. Furthermore, a deep knowledge of market trends is vital for identifying undervalued opportunities.

Regularly re-evaluating your portfolio in light of evolving market conditions is indispensable. This agile approach allows investors to maximize returns while facing the uncertainties inherent in the investment world.

In essence, intelligent investing is a perpetual process that demands discipline and versatility. By honing these qualities, investors can position themselves for enduring success.

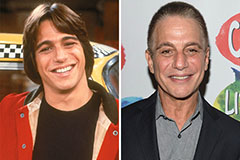

Tony Danza Then & Now!

Tony Danza Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!